A Newsletter for Legacy Partners of the Franciscan Missions

Thinking Outside the Box Gifts by Beneficiary Designation

Did you know that in addition to including a gift for the Franciscan Missions in your Will or Trust, there are other ways to benefit our Missions without the need to change these documents?

There are certain assets that can be used to make a gift through “beneficiary designation.” Often, naming us as a beneficiary of one of these assets is as simple as filling out a form. Beneficiary designations can be for the full amount, a percentage, or can be made contingent depending upon other circumstances.

For example, you can designate the Franciscan Missions to receive some or all of the balance left in your bank or investment accounts at the end of your lifetime. Your bank or broker can provide you with easy directions to complete the change of beneficiary form. You might also be able to find such a form online.

Life Insurance and Commercial Annuities also offer the ability to name beneficiaries, with the benefits typically passed along outside of the probate process. Individual Retirement Accounts (IRAs) and most other “Qualified Retirement Plans” such as 401(k) and 403(b) plans offer a similar opportunity.

By remembering the Franciscan Missions in your estate plan – in whatever way you choose – you will by making a gift that will endure for years to come, serving as a testimony to your love and concern for those who must battle each day just to survive. If you choose to include the Franciscan Missions in your plan, please let us know. It would be our honor to include you in our Legacy of Hope Society, with its perpetual spiritual benefits.

For your reference: our legal title is “General Secretariat of the Franciscan Missions,” our address is PO Box 130, Waterford, WI 53185, and our tax identification number is 39-1396579. (Note: if you have already included us in your estate plans under the title of “Franciscan Missions,” not to worry that will work just fine as long as you include our address and tax ID number.)

Demystifying the Probate Process: What You Need to Know

Many people are afraid of the mysterious probate process. Be not afraid! Below we will describe the nuts and bolts on how the process actually works in practice.

A probate asset is any asset that is not held in joint tenancy with someone else, in a trust or have a beneficiary or pay on death/ transfer on death designation. Typically, probate assets are an asset that someone holds in their own name and no one else’s name. Each state has different rules to what assets are considered probate assets.

The document that controls the probate process is one’s Will. The Will contains the instructions on what happens during the probate administration and who gets the assets once the estate administration is complete. Persons who are named in the Will are known as “legatees.” If a person does not have a Will, the state usually has a default type of Will that applies. If there is no Will and you are entitled to estate assets under the default rules, you are called an heir.

1. Filing the Will and the Court Petition

Once a person with a Will dies, the executor must file the Will with the court. Then the process of transferring his or her assets to his or her legatees/heirs through the probate process begins with the filing of a petition to admit the decedent’s Will to probate (or to administer the estate without a Will), and to appoint a personal representative.

The petition contains factual information about the decedent and attachments to the petition list any heirs or legatees. If the court approves the petition, it will accept the Will for probate (or accept the estate without a Will for probate), and authorize the personal representative to manage the assets of the estate. In general, the personal representative should not distribute the assets to the beneficiaries until the end of the process, which usually takes 6 to 9 months.

2. Notice to Interested Persons

The personal representative has a duty to seek out and inform interested parties that the decedent’s estate is being administered. This is so heirs, legatees, and creditors can make claims against the estate, or challenge the Will. As part of this responsibility, the personal representative is required to publish a notice to interested persons in a local newspaper once each week for three consecutive weeks.

3. Inventory

In some probate cases, especially the cases that ajudge directly supervises, the personal representative must file with the court a list of the decedent’s assetsand liabilities within 60 days of being appointed.This is called the Inventory.

4. Six-month waiting period

The publication of notice in the newspaper starts awaiting period. During this time creditors, claimants, heirs, and other interested persons may present claims against the estate, or challenge the Will. At the end of this time, the personal representative must file an affidavit with the court detailing the steps taken to seek out creditors and claimants.

5. Final Accounting

Once the creditor-claim period described above has elapsed, the personal representative may file a final accounting of the estate in an estate that is under supervised administration. In unsupervised administration, the administrator does not need to file the accounting with the court, but does need to give that accounting to the other interested parties.

6. Final Distribution of Estate Assets

Generally, once all parties agree with the final accounting, the executor distributes the assets in the estate to those who are entitled to receive the assets and then the estate is closed. There are many more steps in administering an estate, but these are the major steps that you should know.

Courtesy of Ben A. Neiburger, Attorney, Generation Law

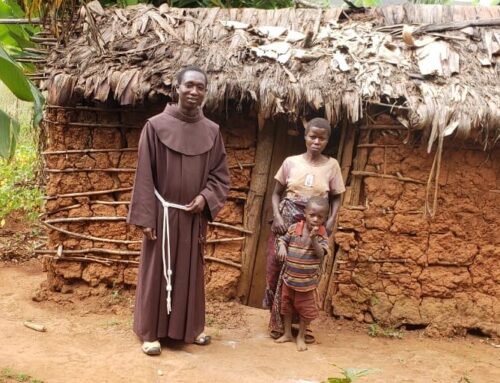

Franciscan missionary baptizes a child in the Amazons of Brazil

Quick Tip: A Tax-Wise Way to Give

Did you know that if you are age 70 1/2 +, you can use a distribution from your IRA to make a gift to support the Franciscan Missions? The process is straightforward:

- Contact your plan administrator to advise that you want to make a “Qualified Charitable Distribution” (QCD) from your IRA to support our efforts. The maximum amount for 2025 is $108,000.

- The distribution should come directly to the Franciscan Missions; you do not want to take the distribution for yourself first.

- Call our office at 262-534-5470 to let us know of your gift and from where it will be coming.

Important Facts:

- You will not be allowed to claim a charitable deduction on your tax return for this gift, however, the distribution will not be considered taxable income when you file your taxes for 2025.

- Those age 73+ are required to take an annual distribution from their IRA. By electing to make a QCD, this gift could potentially place you in a lower income tax bracket as opposed to taking the distribution personally. It can also free up other assets, such as cash, to be used for other purposes.

A Step-by-Step Guide to Organizing Your Estate

Many who begin the estate planning process aren’t sure where to begin; it can seem like an overwhelming task. The Franciscan Missions is pleased to offer our friends a practical, step by step guide to help you organize your assets, all in one handy booklet. This guide can be of great help as you prepare to meet with your attorney to begin the planning process or to refresh the plan that you already have in place.

3 Ways to Request Your Booklet:

call: 262-534-5470

email: plannedgiving@franciscanmissions.org

write to:

Franciscan Missions

Office of Gift Planning

P.O. Box 130

Waterford, WI 53185