As we get older, we come to understand that many of the things that we worried about when we were young seem to be almost insignificant now. That which kept us up at night back then doesn’t seem to matter so much anymore.

As we get older, we come to understand that many of the things that we worried about when we were young seem to be almost insignificant now. That which kept us up at night back then doesn’t seem to matter so much anymore.

Life has a way of putting things into perspective. We reach a point when we begin to consider the difference we have made in this world. We think about the lives that were made better because we were part of them. The term that is used so often these days is “legacy.” This issue of our Legacy of Hope newsletter invites you to reflect on your legacy and on your estate plan, to ensure that it reflects the values that you hold dear.

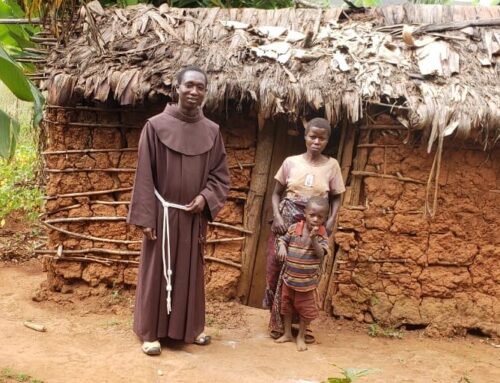

As you review your plan, or create one for the first time, we would be honored if you would consider making a provision for the Franciscan Missions within it. Part of your legacy would then proclaim that you reached out to some of the poorest people in this world when they needed you the most. And you made a difference.

To assist you with your planning, I encourage you to reach out to Linda Knight at 262-534-5470 or at lknight@franciscanmissions.org to request a free copy of our booklet, the Estate Planning Guide. This handy guide will help you to reflect on the people and ideals that are important to you, as well as allow you to list and organize your assets in one handy location.

We Franciscan Friars are truly grateful for all that you have already made possible for us and for those whom we serve. Be assured that you are remembered each day in our prayers and at Mass. Together, we deliver hope.

Gratefully yours in Christ,

Bro. Andrew Brophy, OFM Executive Director

Do I Really Need a Will?

There are certain clubs you don’t want to be a member of, the “I Don’t Need a Will” club being one. It is actually a quite popular one: most Americans are members.

Their reasons are many. Here are five of the most popular:

- “I don’t want to think about dying.”

- “I don’t care what happens after I pass away.”

- “I don’t own much; it’s not worth the effort.”

- “Lawyers are too expensive, and I wouldn’t know how to find a good one anyway.”

- “I own everything jointly with one of my children.”

Let’s take a moment to consider each of these reasons.

1. “I don’t want to think about dying.”

Living with blinders on is rarely a good idea, and most who do will admit that the idea they are trying to avoid never really goes away.

2. “I don’t care what happens after I pass away.”

It’s true, when you pass away, what you leave behind will no longer be of concern. Unfortunately, when someone passes away without a will or trust, the issue becomes a concern for those who are left behind. They are left taking care of many responsibilities without any idea of what your final wishes might have been. To make matters worse, the state in which you live will step in with its own set of guidelines, paying little attention to what your hopes might have been. Peace of mind usually comes from dealing with an issue directly.

3. “I don’t own much; it’s not worth the effort.”

You might be surprised by how much you actually own. Even small bank accounts can make a big difference to another, including the Franciscan Missions. Most of us also have valuables that have been passed on from those who came before us. Instead of risking having those treasures tossed to the side, it can give you great comfort to know that someone you designate will care for them just as you did.

4. “Lawyers are too expensive, and I wouldn’t know how to find a good one anyway.”

It’s true, estate planning attorneys do charge a fee, but the cost of creating a simple plan could be much less than what you expect. It’s also important to keep in mind the emotional cost placed on loved ones to handle your affairs without the roadmap that you could have provided. And as for finding a skilled attorney, try asking your pastor for a recommendation, or contacting the diocese in which you live, or reaching out to the local Bar Association.

5. “I own everything jointly with one of my children.”

This tactic is one of the most common ways people try to avoid the estate planning process. But one needs to be careful, as there are certain pitfalls that come with this approach. Please refer to the article in this newsletter that discusses this topic.

The Potential Problems with Joint Ownership Designations

Owning property jointly, particularly for married couples, isn’t necessarily a recipe for disaster. But be careful … there could be some disadvantages that you need to be aware of.

Holding property jointly is certainly convenient. Generally speaking, either owner can take action relative to the asset. Spouses typically own their homes, bank accounts, etc. jointly. When one spouse passes away, through an arrangement called “right of survivorship,” the asset passes to the survivor without the need of going through probate.

Sometimes parents will include a child’s name as a co-owner, particularly as the parent gets older. Again, convenience makes this an attractive option.

However, there are potential issues that could arise by relying on joint ownership as a form of an estate plan.

For spouses owning property jointly, rarely do they consider that they may both pass away at the same time or relatively close to each other. Without having properly executed wills in place, what happens then? In short, the rules of the state take over. For high-net-worth couples, there is also the possibility of disqualifying themselves from techniques that can reduce estate taxes.

For a parent who jointly owns property with a child, they expose themself to several possibilities. What if there is a lien placed on the child or the child enters bankruptcy? The jointly owned asset becomes exposed. If there are other children within the family, the child co-owner has no responsibility to share the asset with the others – it is his or hers alone.

If that child wants to share with siblings, depending on the value of the assets, there could possibly be exposure to gift taxes. If the parent owns appreciated securities, holding the account jointly could preclude the advantage of a step-up in basis when the parent passes away. One solution to avoid these possibilities is to give the child power of attorney authority without naming the child co-owner of the property.

Rwanda Youth Empowerment

Gifts from Qualified Retirement Plans are vital to Franciscan Missions as we continue to spread the Gospel message to those entrusted to our care.

Your generosity helps us to ease the pain of those who are hungry, homeless, and searching. Please contact Linda Knight at 262-534-5470 or at lknight@franciscanmissions.org to learn more about the tax advantages of making a gift from your retirement plan.

Estate Planning Guide

Whether you are creating your estate plan for the first time or reviewing it for the third time, Franciscan Missions is pleased to offer a booklet that we think could be an enormous benefit to you. Our “Estate Planning Guide” provides you with the opportunity to document the values that you hold dear and the assets that you own, all in one convenient location. To request your free copy of this guide, please contact Linda Knight in our Planned Giving office at 262-534-5470 or at lknight@franciscanmissions.org. We look forward to hearing from you!

Columbia Childrens Music School

Meet Our Legacy of Hope Coordinator

Linda’s experience includes academic advancement and development, corporate and academic research, and extensive volunteerism within community based non-profit organizations.

Linda’s experience includes academic advancement and development, corporate and academic research, and extensive volunteerism within community based non-profit organizations.

“It’s important for me to do work that has a greater sense of purpose, as well as a positive impact upon our world and the environment in which we live. I’m proud of our mission’s work and the projects that we accomplish together here at the Franciscan Missions.”

She has a Bachelor’s in Business Organization & Management from North Park University, Chicago, IL and a Master’s in Information Science from the University of Illinois.

For more information about the Legacy of Hope or including Franciscan Missions in your estate plan, please contact Linda at 262-534-5470 or at lknight@franciscanmissions.org.