Un boletín informativo para los socios del legado de las Misiones Franciscanas

Haz un regalo de fin de año y guarda tu dinero en tu billetera

El padre Hrmenegilde Birushe sostiene a un recién nacido en el dispensario de Burundi.

¿Sabías que puedes ayudar a las Misiones Franciscanas sin gastar tu dinero? Si tienes acciones, bonos o fondos mutuos que han aumentado de valor, donar acciones de valores revalorizados no solo apoyará nuestras labores misioneras, sino que también te ahorrará dinero en impuestos.

¿Por qué es una opción inteligente? Usar un activo con un bajo costo de bolsillo le permite:

- Haz un regalo mucho más grande de lo que creías posible;

- Conserve su dinero en efectivo que pueda utilizarse para otros fines;

- Aproveche una deducción fiscal por donación (si detalla sus impuestos en su declaración);

- Evite pagar impuestos sobre las ganancias de capital.

Al vender inversiones que han subido de valor, normalmente se paga impuesto sobre las ganancias (lo que se denomina ganancia de capital). Pero si donas esas inversiones a las Misiones Franciscanas, no pagas ese impuesto y aun así tienes derecho a una deducción fiscal por el valor actual de las acciones.

Por ejemplo: Si compró acciones por $2,500 y ahora valen $10,000, venderlas le costaría más de $1,000 en impuestos. Donarlas a las Misiones Franciscanas le permite evitar ese impuesto y deducir la totalidad de los $10,000.

¿Qué pasa si desea conservar su inversión? Done sus acciones revalorizadas y luego use su efectivo para comprarlas de nuevo. A efectos fiscales, esto restablece el valor base de la acción al día de su recompra. Al aumentar el valor base, puede ahorrar dinero al venderla posteriormente.

Tenga en cuenta que debe transferir las acciones directamente a nuestra cuenta de corretaje, asegurándose de que las acciones se hayan mantenido durante más de un año y hayan aumentado de valor.

Por favor llame a nuestra oficina y le guiaremos a través del proceso de transferencia; no es nada complicado y este tipo de regalo puede beneficiar tanto a nuestra misión como a usted.

Por cierto, podría haber casos en los que quieras hacer una donación con acciones que se han depreciado. Estaremos encantados de hablar contigo sobre esa opción.

Consejo rápido

Pensando en el futuro: una opción inteligente para transmitir sus activos

Designar un beneficiario para las cuentas financieras suele ser una alternativa más sencilla y segura que la copropiedad. Con la designación de un beneficiario, los activos pasan directamente a la persona que usted elija sin necesidad de pasar por un proceso sucesorio; usted puede mantener el control total de esas cuentas durante su vida. Por el contrario, ser copropietario de un activo puede generar complicaciones, como la exposición a las deudas del copropietario o consecuencias imprevistas si cambian las relaciones. Las designaciones de beneficiarios son fáciles de actualizar y también pueden ayudar a prevenir disputas legales y retrasos. Las designaciones de beneficiarios le ofrecen una opción inteligente y flexible para la transmisión de ciertos activos financieros.

Puede usar la designación de beneficiarios para hacer una donación a las Misiones Franciscanas. Algunos amigos nos han designado como beneficiarios de una póliza de seguro de vida, una anualidad comercial, una cuenta IRA o una cuenta de ahorros/corriente. Agregar o cambiar el beneficiario de un activo suele ser tan sencillo como completar un formulario de cambio de beneficiario, que a veces incluso se puede hacer en línea.

Un fraile ucraniano celebra la misa con niños de la escuela en el sótano de la iglesia.

Un consejo para los sabios: ¿Están actualizadas las designaciones de sus beneficiarios?

Misionero franciscano con niños en una escuela en la República Democrática del Congo

Incluso si tiene un testamento o fideicomiso en vida vigente, sus planes finales podrían verse afectados si los beneficiarios que figuran en sus cuentas financieras, seguros o planes de jubilación están desactualizados. Tenga en cuenta lo siguiente:

- Planes 401(k): Por ley, su cónyuge es el beneficiario automático, independientemente de lo que disponga su testamento. Si su cónyuge se vuelve a casar, su nuevo cónyuge podría heredar esos fondos a menos que se firme un formulario de consentimiento.

- Cuentas IRA: Estas cuentas no se transfieren automáticamente a su cónyuge. Quien figure como beneficiario recibirá los fondos, incluso si sus circunstancias personales han cambiado.

- Seguro de vida: los beneficios se pagan a la persona que usted nombró, evitando así el proceso de sucesión.

- Donaciones benéficas: Puede designar a las Misiones Franciscanas como beneficiario total o parcial de su cuenta de jubilación o seguro de vida. Esto puede reducir los impuestos sobre el patrimonio y los impuestos sobre la renta para sus herederos.

- Fondos asesorados por donantes (DAF): si tiene un DAF, piense en nombrar a las Misiones Franciscanas como beneficiario final: esta es una forma sencilla de generar un impacto duradero en las vidas de personas en todo el mundo.

El bien que haces posible

Ucrania: Esperanza en la oscuridad

Gracias a su generosidad y apoyo incondicional a las Misiones Franciscanas, nuestros frailes llevan el amor y la misericordia de Dios a las personas necesitadas de todo el mundo. En Ucrania, devastada por la guerra, por ejemplo, sus sinceras oraciones, generosos sacrificios y profunda compasión son las que fortalecen a nuestros frailes para acompañar a quienes sufren, ofreciendo esperanza, consuelo y la presencia sanadora de Cristo.

Por tu culpa:

- En Shargorod, el P. Paschalis Rabcevitsch, OFM, distribuye ayuda a más de 275 familias de refugiados. Junto con otros frailes, entrega artículos de higiene y paquetes de alimentos nutritivos a enfermos y ancianos que no pueden salir de sus hogares.

- En Zhytomyr, el padre Leonard Shevchuk, OFM, dirige un programa de comidas a domicilio, y el padre Bernard Petrov, OFM ha lanzado una iniciativa inspirada llamada “Recuperarse para la vida”, un programa de capacitación sobre trauma para voluntarios que acompañarán a personas devastadas por la guerra.

- En Baranivka, el P. Kyryll Topolevskij, OFM, y los frailes han convertido su monasterio en un refugio temporal para refugiados de guerra, que incluye apoyo para madres y niños del este que lo han perdido todo. Para muchos, los franciscanos son la única fuente de consuelo, oración y comida caliente.

- En Odesa, el padre Miroslav Karachina, OFM, está distribuyendo alimentos a más de 1.500 refugiados y a otros 425 ancianos locales que luchan por sobrevivir en medio del conflicto armado.

- En Vylok, el padre Jonas Ban, OFM, dirige un comedor social que sirve 180 comidas calientes al día a personas mayores solitarias, personas con discapacidades y refugiados.

- En Fanchykovo y Korolevo, el padre Márió Weinrauch, OFM, atiende a 215 de las familias más pobres, asegurándose de que reciban paquetes mensuales de alimentos con artículos esenciales como aceite vegetal, harina y arroz.

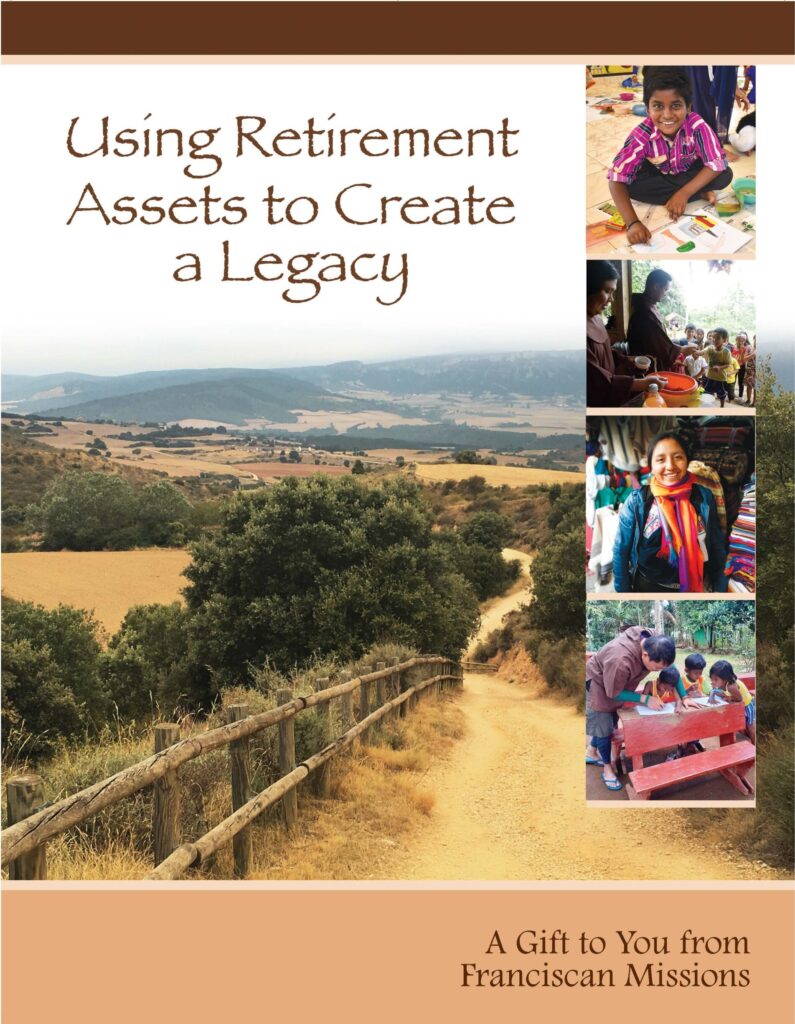

Crea un legado que perdure

Si desea descubrir formas adicionales de apoyar las Misiones Franciscanas, por favor escanea este código

¿Sabía que sus activos de jubilación pueden hacer más que apoyarlo durante su jubilación: pueden ayudarle a forjar su futuro? Nuestro folleto gratuito... “Usar los activos de jubilación para crear un legado duradero” Le muestra cómo convertir su IRA u otros ahorros para la jubilación en una herramienta poderosa para apoyar los esfuerzos de la Misión Franciscana. Ya sea que esté actualizando su plan patrimonial o explorando maneras inteligentes de donar desde el punto de vista fiscal, esta guía ofrece pasos claros y prácticos para generar un impacto duradero en nuestra labor.

3 formas de solicitar su folleto:

llamar: 262-534-5470

correo electrónico: planeadodar@franciscanmissions.org

escribir a:

las misiones franciscanas

Oficina de Planificación de Donaciones

CORREOS. Caja 130

Waterford, WI 53185